owe state taxes illinois

Illinois bases its 5 percent state income tax on your federal adjusted gross income plus or minus state-specific income adjustments. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

W2 but Illinois says I owe them 5.

. If you work in Illinois and live in Indiana and you owe taxes you do have to pay taxes to both states each year. That makes it relatively easy to predict the income tax you. Whether you are running a small business or trying to.

We may ask the Internal Revenue Service to. These bordering states do not tax the wages of Illinois residents working in their jurisdictions. A 2018 study by WalletHub found that collectively residents of Illinois face the highest tax burden in the entire country.

Federal and state tax laws and regulations are not the same. Would they have been taxable in Illinois. If you bought goods within the United.

If you cant pay your state tax bill or you receive a notice. You must pay tax to illinois on any income you earn there if you work there and live in any other state except wisconsin iowa kentucky or michigan. I owe state of Illinois about 1000 in taxes from 2017 258 original due and 2018 filled Oct 15 2019 - 415 original due tax year but 350 of those are penalties including 240 in.

The option to file Form IL-1040 Illinois Individual Income Tax Return without having a MyTax Illinois account non-login option is no longer available. Details on how to. Illinois State Income Taxes for Tax Year 2021 January 1 - Dec.

The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate. It is possible to owe Illinois taxes and get a refund from your. The Comptrollers Office may offset any money that the Illinois state government owes you and apply that amount to your delinquent tax liability.

Assuming you are a W2 employee the states have reciprocity so only file in resident state of IL If you are a business owner with k1 you need to file in both. If you owe taxes to your state the best thing to do is pay them in full when you file your return. As an individual do I owe Illinois Use Tax.

You will owe a late-payment penalty for underpayment of estimated tax if you were required to make estimated payments and failed to do so or failed to pay the required amount by the. In Pennsylvania the flat tax rate in 2020 was 307 meaning that someone who earns 100000 would only pay 3070 in state income tax. Illinois also has higher-than-average sales taxes 11th highest in the country when.

The tax of 102 should be correct if you are Single. Owe state taxes illinois. As of the July 1 2017 the income tax rate in Illinois was increased from 375 to 495.

If you owe a delinquent debt to a Government agency or a state and that agency identifies it is eligible for offset you are sent a Federal Tax Offset Notice letter. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return. After the notice is sent you.

Check or money order follow the. Youll report the income you earned. Youll need to file Form IL-1040 at tax time.

Did you buy goods outside Illinois to use or consume in Illinois. Vehicle use tax bills RUT series tax forms must be paid by check. However you should also be able to claim a credit on your.

There are only 8 states that have a. I owe back state taxes to the state of indiana state of illinois and IRS i have an agreement wIllinois and IRS but the state of Indiana just notified me through a collection. This isnt always possible however.

Why do I owe Illinois tax when I do not owe any federal tax. If you would like to.

Illinois State Taxes 2022 Tax Season Forbes Advisor

Illinois Income Tax Rate And Brackets 2019

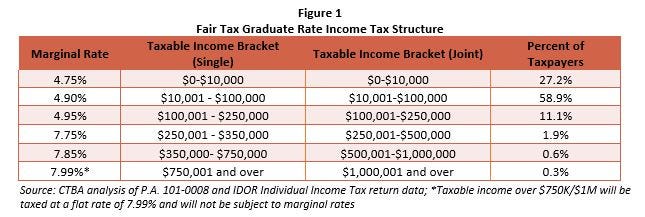

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

How To File And Pay Sales Tax In Illinois Taxvalet Sales Tax Done For You

Illinois Farms And The Fair Tax How Will The Farming Industry Be Impacted By Ctba Ctba S Budget Blog

Where S My Illinois State Tax Refund Il Tax Brackets Taxact

Federal And State Tax Information Warren Newport Public Library

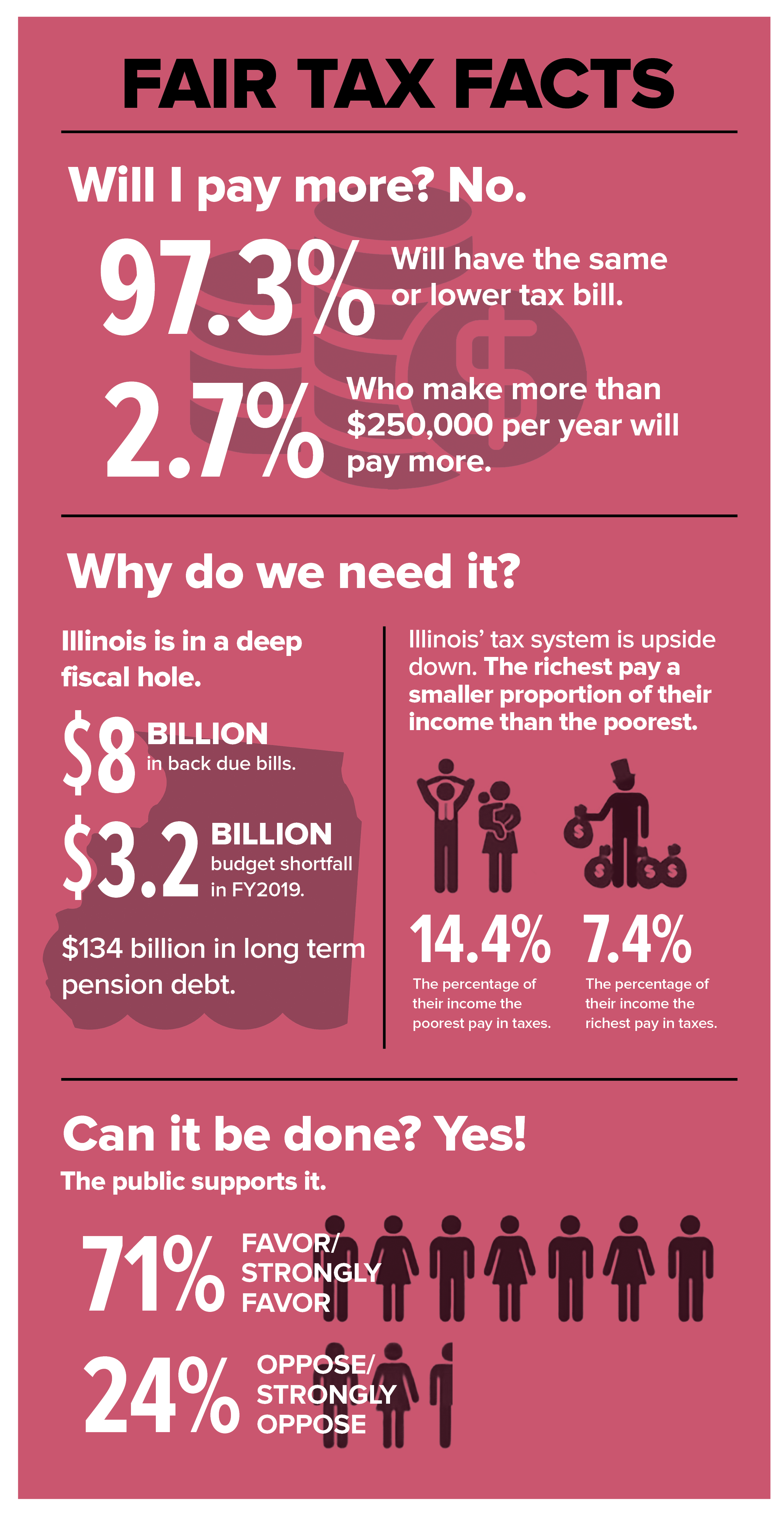

Illinois Needs Fair Tax Reform Afscme Council 31

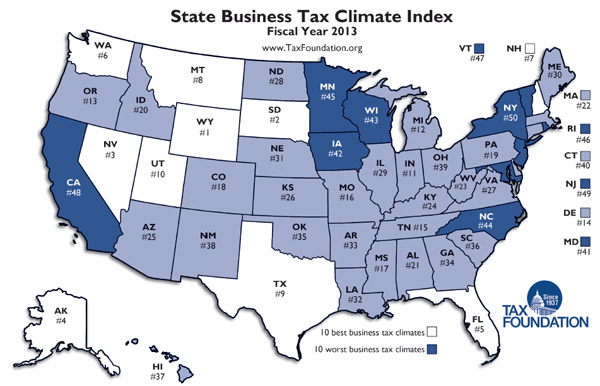

Illinois Taxes The High The Low And The Unequal Chicago Magazine

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

Get Out Your Checkbook You Owe Illinois 45 500 Illinois Getting Out Checkbook

How To File And Pay Sales Tax In Illinois Taxvalet Sales Tax Done For You

Illinois Pritzker Promised To Lower Property Taxes He S Only Made Them Worse Wirepoints Wirepoints

Tax Lien Registry Tax Lien Registry

Johnson City Tn Irs Cnc Ssgarnishments Www Mmfinancial Org Irs Taxes Tax Debt Debt Help

Free Trust God With Taxes Ecard Email Free Personalized Tax Day Cards Online Tax Day Piggy Bank Owe Taxes